A support-focused space where you don’t need to shrink to fit.

If you’ve ever felt like you don’t fit the status quo, ever been told you’re “too much”, or ever felt like you had to wear a mask to be accepted...

If you’re tired of watering yourself down and want a space where you can be real, without fear of judgement, or being pushed to achieve someone else’s version of success...

If you love supporting other women (and want an escape from societal pressures with room for nuanced discussion)...

You’re the woman Inspire was built for.

Here, you don’t have to be anyone but yourself.

You’ll meet women who are kind, intelligent, strong, and just as committed to being real as you are.

Who care about the impact they make in the world as well as about supporting themselves and their families, and achieving their potential as individuals and within their communities.

And who are working to do great work through their businesses or non-profits, as founders.

All our members are founders/owners/the heads of their own ventures - from charity chairs, founders and CEOs, to directors of CICs; from directors of profit-making companies to contractors; from owners of small start-ups, to stable family-run firms, from those growing brilliant tech businesses, to skilled trainers who have teams delivering quality courses in their specialist areas.

We've all sorts of women in Inspire, and they're here to support each other. And you.

For female founders who seek connection and genuine community to help grow their businesses and non-profits... without pitches, posturing or pressure. Seeking peer support? We're for you.

For faith-filled female founders who know that iron sharpens iron, and want quality peer support within a Christian community. If you love God and seek to increase your impact for His glory, join us.

What Makes Inspire Different

We believe that it's good to work. We don't believe in aspiring to be ladies of leisure; we're women who seek to serve, and to be ladies who lead!

We don't aspire to spend our days sitting around twiddling our thumbs - we love doing what we do, and embrace the highs and lows, but we recognise that community is key in helping us stay the course. We believe that income is important, but that it's only going to come if we focus on adding value, creating impact, and are willing to take advice, apply strategic thinking and be willing to learn and grow ourselves. So Inspire's different because it's all about helping each other in these aspirations. That's what we're here for.

Our members are real women, running real organisations (where businesses or non-profits), who are called to make a difference. We aim to deliver value and believe that, as founders, we are called to lead in whatever it is we're doing. Those who join us, do so because they're out there in the real world, doing real work, making a difference, and wanting support in that journey. Because business, leadership and foundership is hard.

We aren't afraid to discourage the wrong people from joining us:

In both The Inspire Network and our free Inspire UK Online Community, we have a "no spiritual talk" rule. Because it can do more harm than good in many cases. Although we recognise that leadership requires "our whole self" and that wellbeing is vital to founders, we seek to protect those in or community from being targeted by solopreneur "spiritual service providers" are not a good fit for our membership - we don't allow discussion on spiritual practices or services, and aim to keep focused on the practical support we're here to offer one another.

We also actively discourage the following people from joining, so Inspire is:

NOT for those who want coaching clients and think they'd find them in our community.

NOT for those who want to find clients generally as their reason for considering joining our membership.

NOT for those who want to use our community to find team for their MLM business and think our community could be filled with their ideal team members.

NOT for those who want an equivalent of BNI or who are professional networkers.

We may refer people to one another but this is not our focus and members don't want to be exploited or used by others when they're in our safe, supportive space.

The exception to our "no spiritual talk" rule is found within our mastermind membership (a safe, supportive space for faith-filled female founders who are aligned in their faith as Christians). Inspired Women is special because it's a unique community for women who want to seek God together, enjoy prayer, worship and masterminding with those who are aligned).

Our Founder is also what makes us unique. Nikki Tapley, a multi-business owner and charity founder, professional business mentor, advisor and strategist with 20+ years of experience in business start-ups, scale-ups, as well as in non-profits.

How Our Founder Leads Us

Nikki has started and grown multiple communities over the years including several comprising thousands of members. Now though, her communities are smaller (intentionally!), with genuine support and masterminding as the focus within the safe spaces she hosts.

Nikki leads Inspire around her main income-generating work, with the help of her team - so she walks the walk and doesn't just talk the talk!

Nikki knows what it’s like to be an Investor, Founder, Director and Non-Executive Board Member, as well as to lead within C-Suite/Head of Dept roles. Her passion lies in bringing transformation through her leadership, but communication, collaborative partnerships, and community-building are strong skills of hers.

When you join Inspire, you're saying "yes" to a community led by a savvy businesswoman, a skilled leader and professional mentor, but Nikki is also focused on philanthropy. She does a lot of voluntary work that most people won't ever hear about, and makes herself available as an affordable strategist and mentor at below-market rate, because has believes it's important to empower others to thrive, and has found first-hand that focusing on impact and serving others leads to a happy and successful life.

At its heart, Inspire is about connection and finding your people. The ones who get what it’s like to juggle expectations, lead with heart, and still feel isolated. The ones who want to build lives (and businesses) with more meaning, more ease, and more joy. This is a place for professional women who are tired of surface-level spaces and watered-down conversations.

Here, you’re encouraged to speak freely, go deep, and connect meaningfully, without being sold to or sized up.

Nikki brings expertise, strategy and structure, yes, but more than anything, she leads from a place of personal faith and fosters belonging.

That means:

🩷 Honest conversations, not performative ones

🩷 A culture of care, not comparison

🩷 Space to connect with women who actually see you

You don’t need to hustle harder or be someone you’re not. You just need the right space- and the right women beside you.

The Heart of Inspire

Community

A space where you can show up as yourself, give and receive guidance, and feel part of something bigger- without anyone needing to prove, pitch, or posture.

Connection

We foster deep, genuine relationships that go beyond referrals and surface-level chats. These are the kinds of conversations that lead to fundamental shifts.)

Support

Whether you need encouragement, strategy, accountability, or clarity, there's always someone here who has your back (and already gets what you're going through.

Impact

We believe that our impact matters, that our work can make the world a better place, and that our efforts can create a brighter future for ourselves and for future generations.

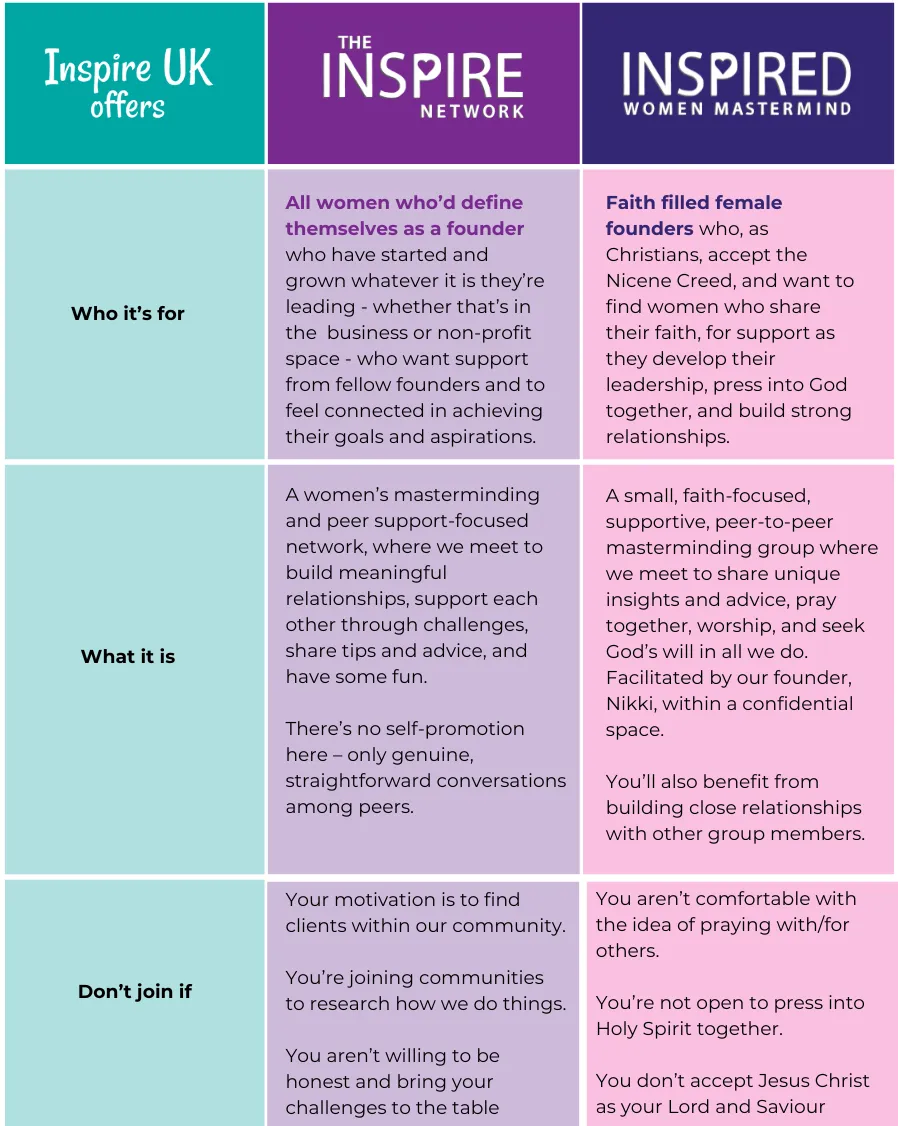

Choose the right fit for you:

Inspired Women Mastermind

For faith-driven Christian founders who want 10K-level peer support, without the 10K price tag. Your investment here is a small amount of time, and a small amount of cash, for huge value. Nikki created this space for women who are committed to their growth and want to seek God with other Christian founders, but who don't want to part with wads of cash to get the support they deserve. To stay in the room, you commit to showing up. Consistently. Because that’s how you'll get the help that makes the difference.

The Inspired Women Mastermind offers Christian-aligned strategic insight, honest conversations, and expert support, without the high-ticket cost. You’ll get the kind of clarity and accountability most women don’t find until much later in their leadership journeys.

🩷 3x 1:1 calls annually with Nikki to maximise your benefits as a member peer mastermind calls (VIP membership upgrade only - a small additional fee applies for this)

🩷 Regular monthly online meetings to mastermind and get support from your peers, pray and worship together, and press into God as well as sharing our wisdom as sisters in Christ.

🩷 Exclusive Members Channel with weekly bible studies, ongoing support and encouragements to reflect

🩷 Preferential access to 1:1 mentoring with Nikki

🩷 Access to all the benefits of The Inspire Network at no extra cost.

🩷 £20/month, cancel anytime

Application only (max. 35 members)

"Being part of a group where other women are juggling the trials and tribulations of family life and running their own business has been encouraging, supportive, educational, inspirational. Not pressured and friendly. I’ve been grateful for this group."

~ Gill

"Since joining Inspire, I've found the meetings and networking opportunities extremely useful. Plenty of people to help and support in all sorts of areas but I've also seen an increase in my sales, many of which have come through Inspire membership. I joined initially to give it a go and see if it was worth it, I'll definitely be sticking around for years to come."

~ Eleanor

The Inspire Network

For female founders who seek connection with other professional women and values-led entrepreneurs for more quality conversations, more support, and way less small talk.

The Inspire Network is the antidote to loneliness and isolation. It’s your portal to meaningful connection- a place to find kindred spirits, make real friendships, and engage in conversations that matter to you. And get access to help in your business or nonprofit leadership adventures.

Whether you’re craving support, insight, laughter, or just someone who understands, this is where you meet the women who truly get it- and want to walk alongside you.

🩷 Monthly online meetings with a masterminding approach - the same quality masterminding our Inspired Women access.

🩷 A designated members channel, with opportunities for accountability, networking, and gaining from sharing insights.

🩷 A trusted space to meet generous, hard-working women, who all have a growth mindset and seek to serve well.

🩷 £10/month, cancel anytime

Meet Nikki

Business mentor. Connector. Straight-talker with a big heart.

“I created Inspire UK to give women a space to grow, in business and in confidence, without sacrificing their values or feeling pressured to follow someone else’s formula, when that’s not what will work for them. With over 20 years of experience, I’ve built businesses from scratch to eight figures, turned around companies in crisis, led powerful communities in the thousands, and helped clients (from solo founders to SAAS startups) scale sustainably and communicate with confidence. The lynchpin that holds it all together is relationships.

That’s why I hold space for women who want genuine relationships, both with me and one another as professionals and business owners, through Inspire! You don’t need more noise or more hustle. You need the right kind of support, from someone who sees the threads between your goals, your message, your mindset, and your community, and helps you align them to drive real growth- in a way that works for you.”

Where values meet vision-and women grow together

FOLLOW US

About

Inspire is a relationship-first space for women in business and professionals who want meaningful connection, shared growth, and to enjoy the life they’re building. Whether you’re here for community, visibility, or support, you’re welcome- as you are.

Contact

Email: [email protected]

Contact Us: www.inspireuk.org/contactus

Copyright 2026. COLLABORATIVE ENTERPRISES LTD. All Rights Reserved.